Today on the Dish, Andrew debunked Jose Rodriguez's "big boy pants" case for torture, reflected on Ben-Zion Netanyahu's life, and discovered Israel's sassy gay friend. We predicted Israeli elections in the near future, broke down the GOP's excuses on bin Laden and Obama, listened to a defense of intervention in Syria, pondered the quandary created by a Chinese dissident in the US Embassy, questioned the morality of drone strikes, and chuckled at an Australian yes-man. Ad War Update here.

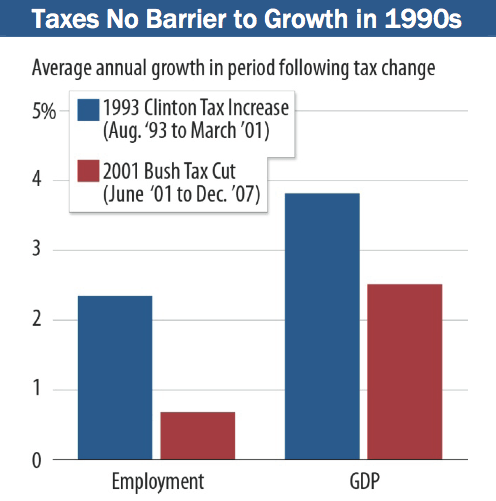

Andrew also criticized the response to North Carolina's Amendment 1, picked out a hopeful moment from the White House Correspondent's Dinner, and responded to critics of the event. We also worried about Citizens United leading to more PAC-driven corruption in Congress, explained why there was no counterpart to the FDA for the financial sector, dubbed Paul Ryan the "Wonk King of the Republicans," laid out the evidence that tax rates could increase without hurting productivity, and parsed Romney's economic plan. Racial profiling failed and the race of jurors mattered a lot.

We also debated whether America needed religion, put the challenge to the Catholic Church in stark terms, found a marriage ruined by monogamy, discovered that money bought happiness (for others) and wrapped our heads around the power of touch. Scientists moved towards in vitro therapies, a father shared his experience raising his brain damaged son, Type II diabetes changed one's life outlook, community colleges failed, and second languages improved analytic thinking. Life experiences shaped film experiences, allergies helped us, homing pidgeons used the magnetic field, a giraffe got a CT in pieces, and the Washington Zoo live-tweeted the artificial insemination of a panda. Ask Tyler Cowen Anything here, Correction of the Day here, Quote for the Day here, VFYW here, MHB here, and FOTD here.

– Z.B.

(Image by Manal Al Dowayan.)