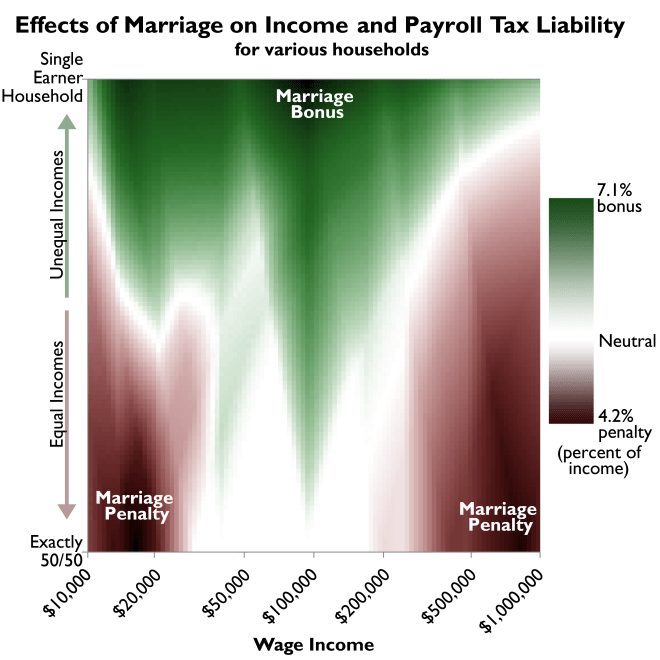

Dylan Matthews digs up a 1997 CBO paper by Roberton Williams and David Weiner on marriage penalties and bonuses:

The income tax code, effectively, benefits single-earner married couples at the expense of dual-earner ones.

And because there are more of the former than the latter, there’s a net “marriage bonus,” or at least there was when Williams and Weiner wrote (which, sadly, is the most recent CBO data available); 51 percent of taxpayers got a bonus, compared to 42 percent who got a penalty, with a net $4 billion bonus overall. Williams says that some changes to the tax code since 1997, such as the introduction of the 10 percent tax bracket, should reduce penalties on the low end and increase the overall bonus rate. Then again, more families today are dual-earner rather than single-earner, which works in the opposite direction.

Matthews goes on the make the case for “cutting the link between taxes and marriage.” I disagree. One reason I wanted marriage equality was because I believe in the way marriage can – but not always, of course – stabilize people’s lives, give us a designated human being to take care of us when sick or unemployed, ease men toward domesticity, support women and men in child-rearing, etc. And I think finding a way to support that in the tax code is a small nudge toward real social conservatism – increasing the ties that bind and the institutions that guide us.

(Chart from the Tax Foundation)