Justin Wolfers analyzes today’s disappointing jobs report:

This report says that we’re barely creating enough jobs to keep the unemployment rate falling from its current high levels. Policymakers have been looking for a signal that the recovery has become self-sustaining. This report doesn’t provide it. And until we’re confident that the recovery will keep rolling on, we should delay either any monetary tightening, further fiscal cuts, and definitely postpone the legislative shenanigans that Congress is threatening.

Neil Irwin finds no silver lining:

Yes, the unemployment rate fell a notch to 7.3 percent, from 7.4 percent in July. Yes, the nation added 169,000 jobs, broadly consistent with the pattern of recent months. But in almost all the particulars, you can find signs that this job market is weaker than it appeared just a few months ago, and maybe getting worse.

The drop in the unemployment rate was caused by 312,000 people dropping out of the labor force. The number of people actually reporting having a job actually fell by 115,000 in the survey on which the unemployment rate is based.

Ezra lists five reasons to be depressed. Among them:

In truth, the most important parts of any jobs report are the revisions to the past two jobs reports. That’s because the initial estimate of how many jobs we added or lost in any given month is typically off by about 100,000 jobs. That’s how you get situations like August 2011, when the jobs report said we created no jobs but we later learned we’d created more than 100,000.

Revisions are where we get that better information. They’re the most accurate part of the unemployment numbers. And in this latest jobs report, they’re a huge disappointment: “The change in total nonfarm payroll employment for June was revised from +188,000 to +172,000, and the change for July was revised from +162,000 to +104,000.” That means we added 74,000 fewer jobs than we thought in June and July.

Annie Lowrey focuses on the long-term unemployed:

The slowly improving economy is not really improving for the long-term unemployed: Short-term joblessness has actually declined a smidge since 2007. Long-term joblessness is up 244 percent.

Felix hopes that this report will stop the Fed from tapering off its stimulus:

[T]his report is something of an unwind of what we saw this summer. It shows that the reality of the economy was not as good as we thought it was, and that the market probably got ahead of itself in anticipating a taper beginning very soon. We can’t take any solace in the mediocre economy. But if you’re desperate for good news, here it is: at least we know, now, how mediocre the recovery is, especially on the jobs front. And we’re going to stop hobbling ourselves by pushing long-term interest rates inexorably upwards, thereby making that recovery even harder.

Binyamin Appelbaum is unsure whether or not this report will prevent the Fed from tapering. Ryan Avent feels that the Fed is repeating the same mistake over and over again:

It is painfully obvious that the Fed dislikes having to deploy unconventional policy and wants to stop using it as soon as possible. One of these days it will realise that the best way to get off and stay off unconventional policy is to push forward with it until the economy is back to full employment and inflation pressures are firm enough to justify interest-rate rises. If you don’t kick the ball past the crest of the hill, it just rolls back down and you have to kick it again. Sadly, it may fall to Mr Bernanke’s successor, and early 2014, to give the economy the boot it really needs.

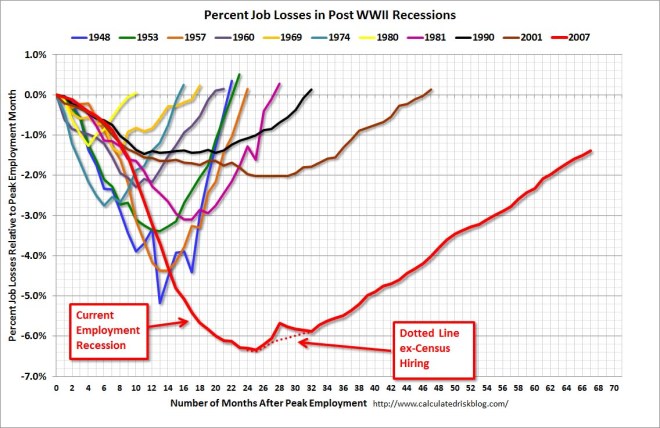

(Chart from Calculated Risk)