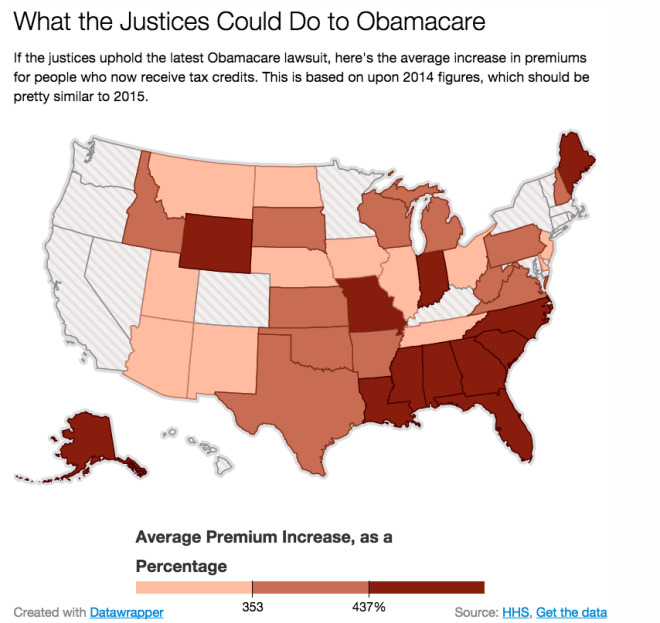

Jonathan Cohn calculates that, should SCOTUS gut Obamacare subsidies in states without their own exchanges, the “underlying premiums for all people buying insurance on their own in these states would rise by an average of 43 percent, while the number of Americans without insurance could be as much as 7 million higher than it would be otherwise”:

More than 800,000 Floridians would see their monthly insurance premiums rise, from an average of around $70 to an average of around $350, or roughly a factor of five. More than 600,000 people in Texas, about 325,000 in North Carolina, and another 275,000 in Georgia would see insurance premiums soar by similar amounts.

Nationwide, more than 4 million people living in 37 states would be in situations like these. Most would have no way to pay the higher bills, forcing them to drop insurance coverage altogether. Their sudden absence would destabilize insurance markets in those states, giving carriers reason to raise premiums by additional amounts or to flee the states altogether—which would, in turn, lead more people to give up insurance.

Relatedly, Suderman points out that affordability is the primary reason individuals go without insurance:

Before last October’s Obamacare rollout, a Kaiser Family Foundation study found that the main reason people had no health insurance was cost. Then, midway through the first enrollment period, the polling firm PerryUndem again asked individuals who hadn’t signed up for Obamacare why they were uninsured. Seven in ten said, simply, “I can’t afford it.”

This makes sense when you realize that a lot of these individuals are barely getting by on many fronts. The Kaiser poll also found that 71 percent were very or somewhat worried they wouldn’t be able to pay their rent or mortgage. Some 61 percent said they were struggling to afford gas or transportations costs, while 45 percent said the same about affording food.

Eight in 10 agreed insurance generally is “something I need.” But given the opportunity, they still weren’t buying it. It seems that the type of “comprehensive” health policies Obamacare requires people to purchase are viewed as a luxury among this population.

Looking on the bright side, Ezra touts Obamacare’s success thus far in holding down premiums:

In September, the Kaiser Family Foundation looked at insurance premiums for Obamacare’s benchmark silver plan in 16 major cities and found, to their surprise, that prices were falling by 0.8 percent on average. On November 11th, they updated the analysis with data for 32 more cities — and found that the initial finding held. On average, prices are falling by 0.2 percent.

“Falling” is not a word that people associate with health-insurance premiums. They tend to rise as regularly as the morning sun. And, to be fair, the Kaiser Family Foundation is only looking at 48 cities, and the drop they record is modest (though this is the same methodology they used in 2014, and to good results). But this data, though preliminary, is some of the best data we have — and it shows that Obamacare is doing a better job holding down costs than anyone seriously predicted, including Kaiser’s researchers.