That "ban on cookies" story is debunked.

(Hat tip: Maddow)

That "ban on cookies" story is debunked.

(Hat tip: Maddow)

America's top baby-mama continues into the semifinals of TV's top-rated show "after her tango with partner Mark Ballas tied for the judges’ worst score." She appears to be pandering for votes:

During the taping of the Nov. 8 show, the 20-year-old Palin wore a Tea Party t-shirt while rehearsing.

The Palins are literally shameless.

The WaPo reports:

A Pentagon study group has concluded that the military can lift the ban on gays serving openly in uniform with only minimal and isolated incidents of risk to the current war efforts, according to two people familiar with a draft of the report, which is due to President Obama on Dec. 1.

More than 70 percent of respondents to a survey sent to active-duty and reserve troops over the summer said the effect of repealing the "don't ask, don't tell" policy would be positive, mixed or nonexistent, said two sources familiar with the document. The survey results led the report's authors to conclude that objections to openly gay colleagues would drop once troops were able to live and serve alongside them.

I don't expect the reactionary right to change its tune on this regardless of the evidence, but this report might still be enough to break loose a few Republican votes for repeal of DADT in the lame duck session.

Adam Serwer compares rhetoric to reality:

While most of the military leadership has signaled their support for ending the military's discriminatory "don't ask, don't tell" policy prohibiting gays and lesbians from serving openly, the Marine leadership has consistently been opposed. The previous Marine commandant, James Conway, estimated that "90 percent" of marines would be opposed to ending DADT, and his successor Gen. James Amos has expressed opposition as well. … The branch of the service most opposed are the Marines, although they're still in the minority at 40 percent, far from the ludicrous 90 percent predicted by Conway.

(Photo: Dan Choi, who was discharged for being gay, stands outside the Times Square Armed Forces Recruiting Center after he reenlisted in the U.S. Army October 20, 2010 in New York City. His paperwork was later shredded by the Army. By Mario Tama/Getty Images)

Felix Salmon isn't too impressed:

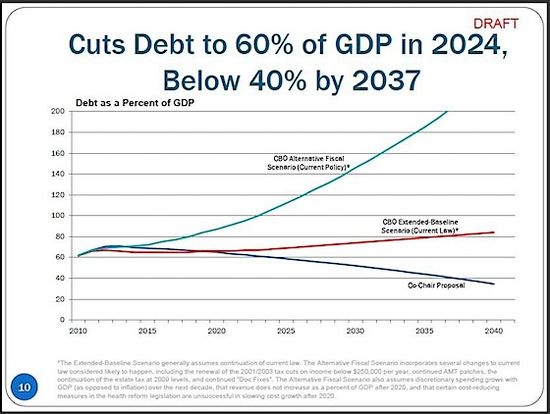

The big picture is in this chart — the proposal gets most of its juice after 2020. Which just happens to be the point at which growth in health-care costs automagically is brought down to GDP + 1% “by establishing a process to regularly evaluate cost growth, and take additional steps as needed if projected savings do not materialize”. But healthcare inflation is a gruesomely difficult nut to crack, and if the CBO simply assumed that it could be solved so easily in 2020, its projections would look much rosier too.

… [B]old ideas in terms of new taxes — carbon taxes, wealth taxes, Tobin taxes, consumption taxes, you name it — are nowhere to be seen: as Jonathan Chait says, this is “a plan that’s tilted, overwhelmingly, toward Republican priorities”.

But Howard Gleckman is thrilled:

[M]y favorite idea is zero-based tax reform. Start by eliminating all tax expenditures and sharply lowering rates to 8, 14, and 23 percent. Then, force Congress to raise rates should it choose to restore specific targeted tax subsidies. This strategy, in some respects, echoes the experience of the 1986 tax reform.

To be candid, this proposal is so provocative it almost seems as if Bowles and Simpson realize they have no chance of building consensus on their own commission. As a result, they may have decided to take their best shot now rather than watch their plan get nibbled to death. If so, it may not have been a bad idea. The fiscal panel may fade away in shame, but I have a feeling this plan may live on.

"A top tax rate of 28% on a much broader base is not a giveaway to the rich; it's more than double what Theresa and John Kerry paid in 2003," – Megan on the Simpson-Bowles plan. Worth reading in full.

I'm convinced. And, yes, Ian Cobain is another doppelganger.

Assessing the preliminary responses to the Simpson-Bowles breakthrough has been a fascinating insight into where we all actually stand on what the Dish regards as the central domestic policy issue of our time: restraining the debt. Ross notes that the proposal – derided by many on the left – is nonetheless remarkably "progressive" if by "progressive", one means protecting the poor:

Yes, it’s tilted toward spending cuts, and away from tax increases. But look at the way it cuts spending and raises taxes. It means-tests Social Security benefits for high earners and raises the cap on taxable income, while also adding a larger benefit for the poorest seniors. Its hypothetical discretionary spending reductions don’t come from anti-poverty programs, for the most part: They come from cutting the defense budget, cutting the federal workforce, cutting farm subsidies, etc. It raises tax revenue by reducing tax credits and deductions that almost all overwhelmingly benefit the affluent. (This would be especially true in the scenario I’d prefer, in which the child tax credit and the earned-income tax credit stick around.) It would cap revenue at 21 percent of G.D.P., which would be higher than any point in recent American history, and well above the average for the last thirty years. And it does all of this, as Chait himself notes, while assuming that Obamacare — the capstone of the liberal welfare state — would remain essentially unchanged.

And it raises revenue without raising income tax rates. Chait admirably calls the proposal "supportable" because of the long-term debt crisis. But here's Krugman and Drum and Pelosi harshing on the entire mean-but-lean government philosophy behind the proposal. The NYT is admirably supportive overall.

All of which leads to an obvious and compelling political and policy win-win for the president. He needs to embrace this opportunity to end the long-term debt and pivot to the center and call the right's bluff at the same time. There is nothing that would restore Obama's cred with Independents more than tackling his own party's ideologues on the deficit and the debt. Since Obama pioneered this debt commission and wanted it to have more power than it does, this cannot be spun as opportunism (and it isn't). It can be seen as part of Obama's promise not to duck these core and tough issues, not to punt on the big policy choices for another generation. And it can be presented as part of Obama's profound willingness to work with Republicans as well as Democrats to put this country back on a long-term fiscally sustainable path.

Such a breakthrough, I believe, would also galvanize a recovery, restoring long-term confidence in the US economy, and prompting businesses to spend, invest and hire again.

This is Obama's moment. He needs to seize it with clarity, focus and drive. If he does, he will regain the coalition he won with – and then some.

Hanover, New Hampshire, 9.30 am

Kevin D. Williamson heroically rattles NRO readers:

A reader asks: “So an Obama commission proposes a $1 trillion-plus tax hike, and you, a managing editor at the flagship conservative publication, endorse it? Exactly how or why is this a conservative position?”

Answer: A conservative’s first duty is to deal with reality — not with the theoretical world we wish existed, not with ideology, and not with wishful thinking. We are running a deficit of 40 percent, and it is implausible to think that a government with a Republican House, a Democratic Senate, and Obama in the White House is going to balance the budget by cutting 40 percent of spending. I think it is equally implausible that a government with a Republican House, a Republican Senate, and Ron Paul/Sarah Palin/Mitch Daniels/Rush Limbaugh/The Ghost of Ronald Reagan in the White House is going to balance the budget with spending cuts alone. Why should I rely on the performance of theoretical Republicans when I have the evidence of actual Republican Congresses and actual Republican administrations to inform me that radical spending cuts are unlikely under a unified Republican government?… If I see a better plan with a real chance of being enacted, it will have my support. But given a choice between an ideologically pure program that never is enacted and a problematic one that gets the job done, albeit imperfectly, I’ll take real deficit reduction over theoretical deficit reduction every time.

It is extremely heartening to see such a prominent conservative writer put policy before partisanship. Ramesh Ponnuru offers his take here. Earlier thoughts here. Reax here.

Fallows engages his critics.