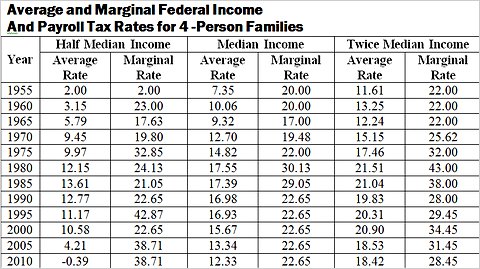

Bruce Bartlett, having shown that tax revenues as a proportion of GDP are at 50 year lows, now takes up the issue of tax rates. Are they higher than they once were? Only for the very poor, because of the EITC. Video here. Money quote:

As one can see, average tax rates on the working poor have never been lower; in fact, they pay neither income taxes nor the employee’s share of the payroll tax, because the earned income tax credit offsets both and even gives them a small refund on top.

However, the tax credit is phased out at a rate of 21.06 percent for families with two children after their earned income reaches $16,690. The loss of a refundable credit is exactly the same, economically, as paying more taxes, and this is what imposes such high marginal rates on the working poor.

A typical middle-class family, on the other hand, is paying less in federal taxes than it has since 1967. Its marginal rate is also down substantially since it peaked in 1982 at 31.7 percent. The well-to-do family, too, has seen its average and marginal tax rates decline substantially.

Maybe it helps to use the Reagan nirvana of 1985 to persuade conservatives. In those glorious days of conservative triumph, the marginal tax rate for the median income family in the middle class was 29 percent. Today, it's 23 percent. The wealthy/successful have seen their marginal rates drop from 38 to 28 percent. If jobs are not returning, it's not because taxes, either as a whole or in terms of marginal rates, are too high.