Bruce Bartlett angers up the blood a little:

According to new data from the Tax Policy Center, this year 46.4 percent of tax filers will have no federal income tax liability.

Much of that is due to poorer EITC households and some middle class ones with child credit. But it also true that:

There are 78,000 tax filers with incomes of $211,000 to $533,000 who will pay no federal income taxes this year. Even more amazingly, there are 24,000 households with incomes of $533,000 to $2.2 million with zero income tax liability, and 3,000 tax filers with incomes above $2.2 million with the same federal income tax liability as most of those with incomes barely above the poverty level.

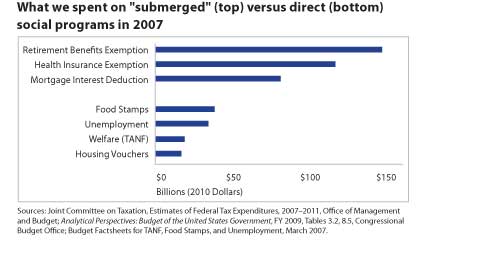

Doesn't this pose a risk to social stability and market efficiency? And don't forget the impact of tax expenditures, i.e. middle class subsidies. They have long since displaced aid for the poor in the outlays of the federal government:

Suzanne Mettler makes a compelling progressive case for ending these tax breaks for so many.