From Nate Silver's post on "Why S.&P.’s Ratings Are Substandard and Porous":

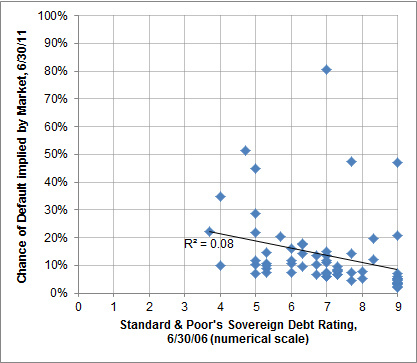

[The chart] presents a comparison of S.&P. ratings as of June 30, 2006, to the risk of default five years later (on June 30, 2011) as measured by the prices of credit default swaps, financial instruments that pay an investor if there is a default on a bond obligation.

S.&P.’s bond ratings from five years ago would have told you almost nothing about the risk of a default today. They had no insight about the threats in European markets, nor about which countries in Europe were relatively more likely to default. (Norway, which remains among the most solvent countries in the world, had a AAA rating in 2006, but so did Ireland and Spain.)

By comparison, simply looking at a country’s ratio of net debt to G.D.P. would have been a better predictor of default. It wouldn’t have done well by any means: it only explains about 12 percent of default risk. Still, this simple statistical indicator does better than the S.&P. ratings.