by Zoë Pollock

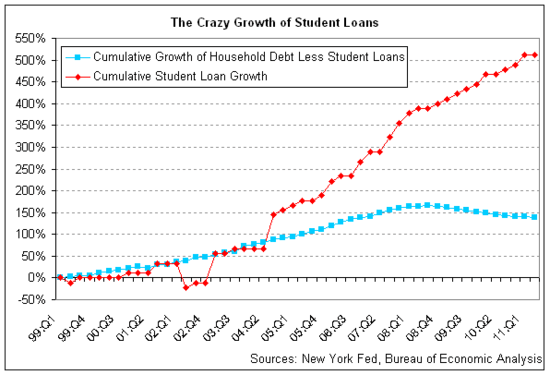

Student loan debt has ballooned by 511% since 1999. Daniel Indiviglio fears it could signal slower economic growth for the US as a whole:

As Americans grapple with high student loan payments for the first few decades of their adult lives, they'll have less money to spend and invest. All that money flowing into colleges and universities is being funneled away from other industries where it would have been spent in future years. Of course, this would be a rather unfortunate irony: higher education is supposed to enhance a nation's growth, but with such an enormous debt burden, graduates might not be able to spend and invest enough to allow that growth to occur.

Liz Dwyer notes that "the growth of student loan debt was twice as steep as the growth of mortgages and revolving home equity from 1999 to the peak of the housing bubble in 2008." Walter Russell Mead blames a broken system:

[I]ntelligent students should not be barred from a good education simply due to the poverty of their parents. These loans, however, pervert incentives for the schools: rather than forcing schools to compete by delivering a better education for a lower price, the abundance of loans guarantees a steady flow of students even as prices rise into the stratosphere.