There’s no question that we are in a post-financial crisis recovery, long and puny. There’s also no question that Obama will take major lumps for it. But for the Republicans to make a case for his specific failure, they have to come up with a plausible scenario for how they would have handled this period in American history differently. From that comes a plausible account of how they’d take us forward from here. So far, we’ve had little but rhetoric, but James Pethokoukis takes a stab in Commentary. I’m not trained in economics, so I’ll leave some of the claims to others to discuss. But here’s the core case:

Instead of saving us from a Greater Depression, the Obama stimulus (together with his health-care plan and financial reforms) was a two-year waste of precious time and money that may actually have impeded economic growth.

That’s a provocative thesis, to say the least. The evidence?

White House economists predicted the stimulus would prevent the unemployment rate from hitting 8 percent. But the rate actually rose as high as 10.1 percent, has settled in above 9 percent now, and even Obama’s own team currently hopes for a rate of, at best, 8.25 percent by the end of 2012—if nothing else goes wrong.

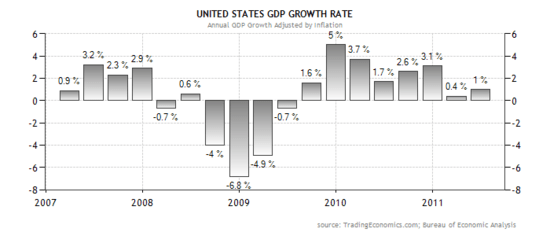

Well, that’s because they were predicting employment based on contemporaneous estimates that the US GDP was contracting at around 3 percent in the fourth quarter of 2008. As you can see from the above corrected data, that estimate was off by a half. The recession was much steeper than anyone realized at the time. Blaming economists for projecting off inaccurate data is not the same as indicting them for having a stimulus in the first place. And, yes, the stimulus – put together in a frantic rush – merely stabilized demand, and did not reverse it. The Krugman thesis – that we should have put through a far larger stimulus – was, given the assumptions of the time, an impossible sell. And the paucity of real shovel-ready projects was a problem. The same goes for the next stimulus: it will probably help us avoid a double-dip, but not much more. Much of the tax cut money in the past was saved, not spent. And that problem applies to the GOP’s and Obama’s prescription as well: tax cuts are not always the best way to stimulate the kind of economy we are now in. (Although increased rates of private saving will, in the long run, surely help stimulate demand. It just takes time). But what if we had done nothing? Or slashed spending instead? Pethokoukis admirably notes that this is a thought experiment – Bush began the bailouts and the stimulus, and it’s hard to see how any president, with the risk of the entire global economy going down the tubes, could have done otherwise. But he argues that such a hands-off approach would have facilitated a faster recovery and we would not be stagnant as we now are.

This is a counter-factual that cannot be proven, but it strikes me that without the stimulus, there was a real chance of a spiral downward in growth of historic proportions, and that the unemployment rate today would be much, much higher than 9 percent. And you think Peggy Noonan would he heralding that as a success?

You also have to factor in how this recession accelerated trends in automation in manufacturing, in outsourcing, and in the loss of well-paid skilled work for the middle classes. Again, none of this is new, but it has come to a head. This recession ended only to have Americans greet a highly competitive global economy, where America’s former advantages have been equaled or beaten by competitors, especially in Asia.

The truth is also, as Pethokoukis notes, that we are at the end of a long spasm of government binging – on discretionary spending, entitlement growth, wars and tax cuts, that began under Bush and Cheney. Keynes himself was leery of big stimuli if the economy was already leveraged to the hilt. He believed in running surpluses in ordinary times of economic growth. Given all this, I find Obama’s stimulus to be the least-worst option feasibly available to policy makers given the horrifying legacy he was bequeathed. It wasn’t so small it had no impact; it wasn’t so large it made our debt crisis even worse. The mistake – if there was one – was to raise expectations for recovery beyond what the new globalized world will allow.

We are, after all, not alone in this. Europe looks headed to a stalled economy next year; Japan’s recovery from a similar financial crisis took a decade. When you have private and public debt at the levels we have, the idea that we can turn an economy around in a year or so is ludicrously overblown. Obama did what any responsible president would have. It wasn’t enough. And so we grind pragmatically on. And if that were the tenor and substance of the debate: how we build on the stimulus to steer the economy to more employment more quickly, we’d all be better off.