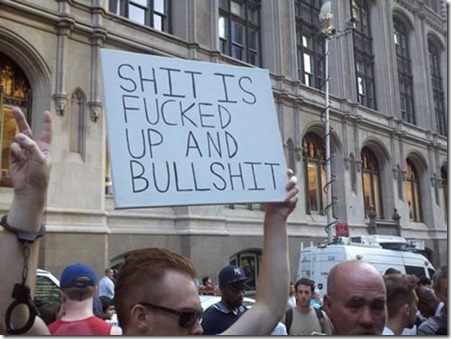

Yes, at one level this is Cartman-bait. On another level it's surely true. It's dawning on people that this recession really is different. It's a classic post-financial crisis recession – slow, uneven, uncertain. But it's also a recession lacking any new industry to power new growth and accompanied by a technological revolution that is making human beings less relevant to labor than ever before. Think factory automation; or the jobs lost in, say, the music or journalism industries. The only growth sectors are those where you need people near other people to perform key tasks, like healthcare. And on top of all this, this is the first recession that the US has exited, or tried to exit, with two billion new people integrated into the global economy, from India, China, Brazil and elsewhere. Information technology also makes distance less problematic – and so outsourcing continues apace, in white collar jobs up and up the food chain.

Shit is fucked up and bullshit all right. Except that this isn't a conspiracy. It's a function of choices we made as a democracy: to defeat Soviet and Chinese communism; to ramp up private and public debt in good times rather than tackle deeper problems in education and infrastructure; to enlarge the global economy; to foster innovation. We are, in this sense, a victim of our own success.

So what now? The GOP response is to cut spending drastically and cut taxes and regulations even more drastically. The trouble with this approach is that this is not 1983. Three decades of low tax rates have not produced record-breaking growth (au contraire, alas) and have made the US close to bankrupt under any normal measurement. Only by printing money, and relying on being the investment of last global resort, are we able to stay afloat. I don't, however, believe we can simply wish the debt away as we concentrate on jobs. The two, to my mind, are connected. Confidence swooned after the failure of the Obama-Boehner Grand Bargain; and long-term constraints on Medicare spending are essential – above and beyond the cost controls in the ACA – if we are to regain any sense of optimism about our future. This healthcare drain is a huge burden on private business and a major disincentive to hire new employees – which is why it's odd, if predictable that the GOP never mentions it. They have to believe in totally private medicine as the best option, despite its rank failure to be anywhere close to as efficient as socialist schemes elsewhere. This is the kind of dogma conservatism has to abandon in favor of empirical analysis.

The president should not, in my view, abandon his Jobs Act – but neither should he tout it as some sort of solution. It isn't – and neither was the last stimulus. They are negative acts designed to prevent a spiraling economy from plunging into a self-sustaining abyss. And Obama is not going to get re-elected on damage limitation.

He should, instead, back a big, serious program of infrastructure spending, of the kind laid out in "The Way Forward," presaged by Joe Nocera today. Bottom line:

A sustained infrastructure program, lasting from five to seven years, to create jobs and demand. “Labor costs will never be lower,” says Hockett. “Equipment costs will never be lower. The cost of capital will never be lower. Why wait?” Their plan calls for $1.2 trillion in spending — not all by the government, but all overseen by government — that would add 5.2 million jobs each year of the program. Alpert says that current ideas, like tax cuts, meant to stimulate the economy indirectly, just won’t work for a problem as big the one we are facing. Indeed, so far, they haven’t.

Their second solution involves restructuring the mortgage debt that is crushing so many Americans. It is a complex proposal that involves, for some homeowners, a bridge loan, for others, a reduction in mortgage principal, and, for others still, a plan that allows them to rent the homes they live in with the prospect of buying them back one day.

I'm not expert enough to judge the details here. But this notion of thinking big does seem to me to be good political and economic advice. We don't want to look like Japan in a few years' time. Americans, moreover, won't tolerate it. And a serious infrastructure program was something Romney backed in 2008. A second stimulus that focused entirely on this kind of infrastructure upgrade – roads, high speed rail, broadband, high schools – could capture the imagination and also tackle the actual deep-seated problems that can be engaged, as opposed to monthly jobless figures which once can merely fiddle with for years.

Am I now an apostate from conservative economics? In some respects, many on the right would say so. But my core belief is that this is not 1979. We do not have sky-high taxes and rocketing inflation. We have lower revenues than at any time since the 1940s and a constant risk of deflation. The rest of the world is not coming to our aid – and Europe could be facing its darkest days since the 1940s. Protectionism is no solution. And the bond markets are signaling that they'd be fine with more spending in the US.

This time, in other words, it's different. And in my view, the core task of the conservative mind is to be open to the present moment, clear-eyed in trying to understand it, and flexible on solutions. Government must play a role in this. In my judgment, Obama can easily say that he tried to advance bipartisan solutions to the debt problem but failed because of Republican intransigence on revenues. He can then say he has no choice but to advance proposals on his own, to be carried out after the next election if politics prevents it beforehand. It would be a turn to the left – but in order to save the capitalist system, and its credibility with most Americans.

For this is the deeper danger. If we continue as we are, fighting over a shrinking pie, and if those who have made vast fortunes over the past three decades refuse to contribute their share to solving it, and if ordinary Americans believe that these people have bought the Congress, then we're talking serious social unrest. Occupy Wall Street is a puppet show compared with what could be coming. Americans aren't Japanese. They do not take decline and depression stoically – and if such decline is seen as one that exempts the global moneyed elite, watch out. Leveraging that instinct for radical reform – I'd favor both a big infrastructure package with full-scale tax reform to raise revenues and reduce rates – will be critical to America's endurance as the world's richest and most innovative nation.

Can Obama pivot in this way convincingly? That's his challenge. Can we rally behind him if he does? That's ours.