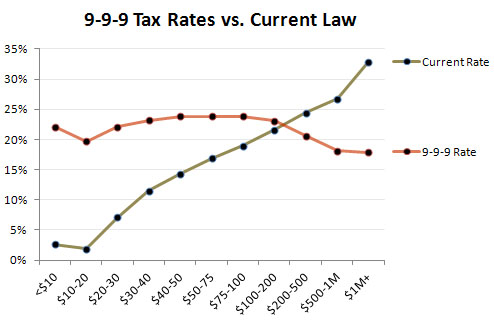

This chart, showing the regressive nature of Cain's tax plan, and other charts like it, are making the rounds:

Howard Gleckman looks at how various households would be impacted by 9-9-9:

A middle income household making between about $64,000 and $110,000 would get hit with an average tax increase of about $4,300, lowering its after-tax income by more than 6 percent and increasing its average federal tax rate (including income, payroll, estate and its share of the corporate income tax) from 18.8 percent to 23.7 percent. By contrast, a taxpayer in the top 0.1% (who makes more than $2.7 million) would enjoy an average tax cut of nearly$1.4 million, increasing his after-tax income by nearly 27 percent.