A reader writes:

As a consistent reader of the Dish, I am aware of your strong opinion of the financial sector bailout: it was absolutely necessary to prevent Armageddon. Unfortunately, I have to agree. The government was able to avert a disaster that is truly impossible to imagine, and while the results are hardly perfect, I prefer them to whatever "Mad Max" style scenario would have resulted from refusing to rescue the industry.

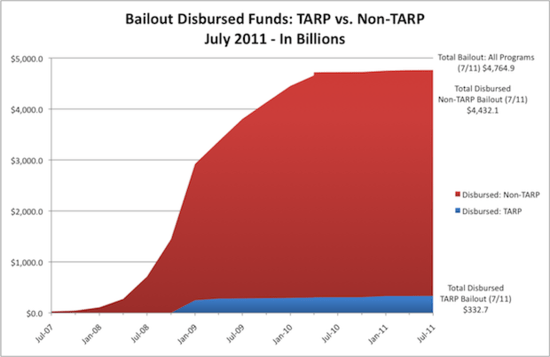

Nevertheless, you cannot claim that the bailout is a rousing, profit-generating success. The sums presented in your link highlighting the bailout's profitability are not only laughably tiny ($6 to $20 billion, maybe) but also describe ONLY the performance of TARP. The world seems fixated on TARP as a measuring stick for the government's response and the banks' accountability. And yet, as we now know, an audit of the Federal Reserve has demonstrated that the Fed's total involvement in rescuing the global financial industry is somewhere approaching 16 trillion dollars, several trillion of which were disbursed to financial institutions in foreign nations.

The audit, done by the Government Accountability Office and available here, has failed to become a top-of-the-heap story, but that shouldn't be a surprise. No one – not the Obama Administration, the Fed, Wall Street, their Republican friends, or anyone other than people interested in the true costs of the Great Recession (or Great Failure) – has an interest in that information becoming a true story. Dodd-Frank forced the audit via an amendment by Sen. Sanders (which he rightfully crows about), and Dodd-Frank also required disclosures of who received trillions of dollars in emergency loans, disclosures which the Fed and the Clearing House Association have been fighting for years.

The result is that the know-it-all college hippie who was probably holding the "WE WANT OUR BAILOUT MONEY BACK" sign may actually be more right than he knows or understands. Sure, the bailout was a necessary evil, but don't present it as a profitable, unqualified success. TARP receives the focus, but it was but a sliver of an inconceivably enormous intervention by the US government which, let's face it, will NEVER be "paid back." And even TARP itself has been lambasted by the very man who ran it and was largely financed by borrowing at a thrifty 0% interest rate. By endorsing the idea of the profitability of "The Bailout," which is really just TARP, you are endorsing a completely mythical representation of the government's response and Wall Street's supposed accountability.

The overall point becomes incredibly disheartening and only shores up the anger of OWS even more: "The Bailout" was 30 times the size of TARP, TARP itself has been largely repaid thanks to favorable borrowing practices allowed by the Fed, and the culture which allowed the entired disaster to unfold has not been forced to examine itself for one second. As Vanity Fair recently put it, Wall Street views the entire incident with a "Shit Happens" mentality, shrugs its shoulders, and now feels persecuted by OWS and the outrages of Dodd-Frank.

(Chart, which appears to show only US-based bailout, via EconMatters)