It would blow a massive hole in the deficit and make the tax code much more regressive. Howard Gleckman does the math:

Everyone in the top 0.1 percent would be better off than under 2011 rates and they’d get an average tax cut of $1.9 million. Among those in the bottom 20 percent, only about one-quarter would be better off under the Gingrich plan. Overall, low-income households would get an average tax cut of $63. … Because the plan is so much more generous when compared to current law, the overall cost of the Gingrich plan is even greater. He’d reduce revenues in 2015 by nearly $1.3 trillion, or 35 percent of federal taxes that year. Talk about starving the beast!

It would also require destruction of vast swathes of government:

Gingrich’s plan would leave enough money to cover the cost of so-called mandatory spending, a category that includes Medicare, Medicaid and Social Security, along with part of the interest on the U.S. debt. Dedicating the money for those purposes wouldn’t leave any funds for defense spending or any other federal agency.

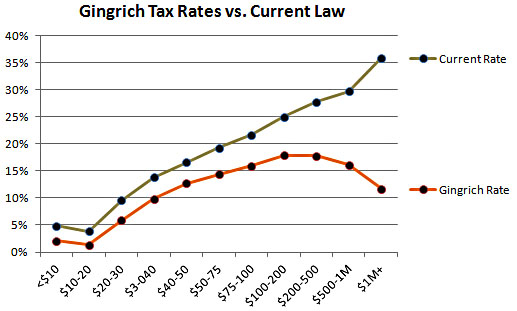

So unless the miraculous Lafferite effects take off like a rocket, Newt would have to zero out all defense. Chart from Kevin Drum, who comments:

In order to make sure that not a single person would even theoretically pay higher taxes under his plan, Newt uses the dodge pioneered by Rick Perry that allows taxpayers to choose between the current tax code and the Gingrich plan. However, he goes Perry one better by being even more brazenly pro-millionaire with an effective rate of 11.2% for anyone earning more than a million dollars per year.1 Take that, cowboy!