Krugman claims "the low tax rate on capital gains is bad economics." Jared Bernstein is on the same page. Brad Plumer looks at the evidence:

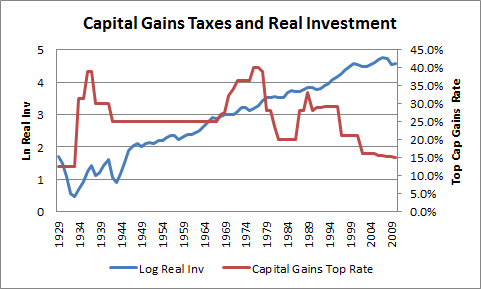

Troy Kravitz and Len Burman of the Urban Institute have shown that, over the past 50 years, there’s no correlation between the top capital gains tax rate and U.S. economic growth — even if you allow for a lag of up to five years. “Moreover,” they add, “any effect is likely small as capital gains realizations have averaged about 3 percent of GDP since 1960 and have never been more than 7.5 percent.”

Reihan counters:

If Trabandt and Uhlig are right and Cowen and Bernstein are wrong about capital gains taxes, the consequences for growth could be very significant. Denmark and Sweden are, according to this framework, growing despite their level of capital income taxation, not because capital income taxation has no impact or a negligible impact.

Yglesias's view:

Capital-gains tax cuts are extremely regressive, so if you really are a big believer in the growth-sparking impact of lower rates, the reasonable thing to do is offset the budgetary impact of the cut with a big progressive hike in ordinary income tax rates. If you're not willing to do that, then you're really just offering rich people a giveaway. Incurring the massive direct dissavings involved in a deficit-financed tax cut in exchange for some very-possibly-not-there incentive effect is crazy.