by Patrick Appel

Ezra Klein worries about it:

The problem, put simply, is that "the Troika" — the IMF, the EU, and the European Central Bank — want more concessions than the Greek political system seems to be capable of making. They want the minimum wage cut by 25 percent. They want supplementary pensions cut by 35 percent. They want to close 100 state-run organizations that will cost thousands of jobs. And they want all this done voluntarily by the politicians in a country that has gone, in a few short years, from 7.5 percent unemployment to 18.8 percent unemployment. And if it's not done, the next bailout won't come through, and Greece's default will become disorderly — with untold, but clearly disastrous, consequences for both Europe and the United States.

Ryan Avent looks at whether Greece could take the rest of the world down with it:

The odds of euro-induced global recession have gone down, but the euro-zone crisis will be one of the biggest downside risks to American growth in 2012. There's just no avoiding that.

Felix Salmon expects a reckoning relatively soon:

Greece and the Troika might not be able to agree on whether the latest deadline has been missed, but there’s one deadline no one can move: March 20, when Greece’s big €14 billion bond issue comes due. Either there’s an exchange offer in place by that point — or else the European project will have failed.

Krugman is pessimistic:

[W]e’re now looking at a scenario in which Greece is forced into killing levels of austerity to pay its foreign creditors, with no real light at the end of the tunnel. This is just not going to work.

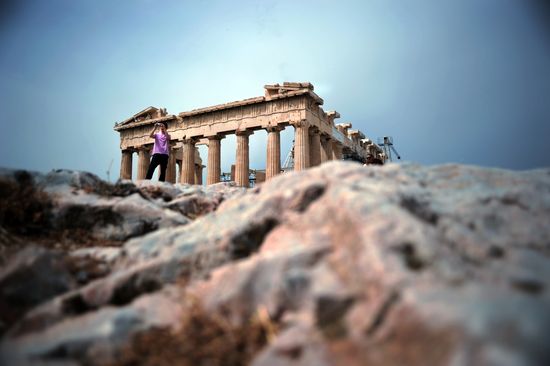

(Photo: Dimitar Dilkoff /AFP/Getty Images)