Yglesias is untroubled by America's growing debt. Millman counters:

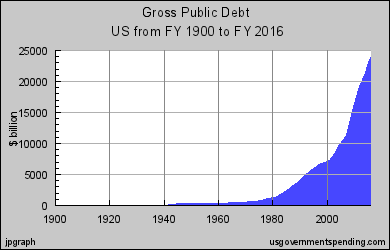

Borrowed money needs to be repaid or rolled over at whatever interest rates prevail in the future. And the party won't last forever – eventually, the United States will not enjoy the advantage of borrowing so cheaply. Indeed, we hope we don't – our cheap borrowing costs are substantially a function of things that are wrong here and elsewhere in the world (uncertainty about the Euro-zone, the underdevelopment of Chinese financial markets, slow real growth prospects in the United States) that we hope will be ameliorated over time. If we borrow primarily in order to finance current consumption, we will not have improved our capacity to shoulder the burden of the debt we incur. But we will have gotten used to a higher level of consumption than we can actually support with our own productive activity. That's not just a missed opportunity. That's the road to a crisis.

And that's why, despite some incredulity at a Catholic's decision to balance the entire budget on the backs of the poor and cut taxes on the wealthy after three decades of soaring inequality, I can see the attraction of Ryan's proposal, in its long-term impact on the debt. It does twice as well as Obama. And the refinement of his Medicare proposal is a positive thing. But the fantastic cuts to basically all discretionary spending, the decision to forgo tax reform as a means to raise revenues as boomers retire and the working poor cope with harsher and harsher global competition, and the meekness of the defense proposal make this the right target wrecked by truly skewed, ideologically-driven priorities. I think Matt Miller grasps the core point – and illustrates why the GOP has now become unmoored from its conservative sister party in the UK:

The crucial thing to understand about Ryan is that he is not a fiscal conservative. He’s a small-government conservative. These are very different things.

The fastest-growing federal program in Ryan’s new budget is interest on the debt, which nearly triples from $234 billion next year to $614 billion in 2022. He doesn’t even pretend to balance the budget until 2040, and then only under utterly dubious assumptions. These are not the choices a fiscal conservative makes. A fiscal conservative pays for the government he wants. Ryan wants government smaller than the one Reagan led even as America ages, and he doesn’t want to pay for it. Instead he adds trillions in new debt and makes no bones about it.

Politically, it seems to me, the balance in this package, its draconian cuts for the poor and lavish further goodies for the rich, and its delay of a balanced budget for thirty years, make it an easy target. I wish the Obamaites could grasp tax reform as a key revenue raiser and move closer to Ryan's realism on Medicare.

But for now, fiscal conservatives are again homeless. Romney's massive proposed increase in defense spending and his refusal to raise revenues puts him in a tight box of brutal entitlement cuts when he claims to want to cut, cap and balance the budget. Obama came near to the kind of Bowles-Simpson Grand Bargain last summer – but it fell apart. Could a re-elected Obama try again? I guess we can hope, can't we?