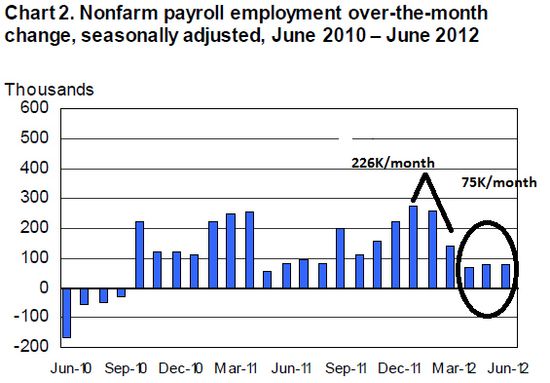

Yglesias puts today's ugly jobs numbers in context:

[W]ith revisions we have 80,000 jobs in June; 77,000 jobs in May; and 68,000 in April. Three makes a trend is the rule of journalism, so that is definitely a new weak trajectory for job growth. You'd need about 200,000 new jobs a month to be making meaningful progress toward reducing the unemployment rate. The good news, such as it is, is that the trajectory is upwards. That's visible in the headline jobs numbers and in the fact that both wages and hours worked went up in the June report. But I think it's clear that we're settling on a no-recovery path.

Jared Bernstein agrees:

Today’s report suggests that the downshift looks real, and that’s what should be absorbing policy makers’ time and energy. Unfortunately, in an hotly contested election year, they’re more likely to target each other than to target the job market.

Ezra Klein wants Fed action:

[W]ith Congress largely on the sidelines, inflation low, and the labor market recovering, there’s a stronger and stronger case for the Federal Reserve to step in more aggressively. “The big question is whether this is a weak enough report to get the Fed to move,” writes economist Justin Wolfers. “I think it is, and they will.”

So does Ryan Avent:

As this new jobs report makes clear, the Fed is falling wildly short on the employment side of its mandate; unemployment remains more than 2 percentage points above its estimation of the "natural rate" of unemployment. All the more striking, then, that the Fed is also falling ever farther short of its inflation target, as well. The Fed next meets from July 31st to August 1st. These new jobs numbers will raise hopes for action, potentially including a third round of balance-sheet expansion via asset purchases: QE3.

Peter Boockvar, on the other hand, doubts the power of cheap money:

Bottom line, the 3rd straight month of job growth below 100k is pathetic with an average of 78k in that time. The weakness in April and May were likely due to some weather give back from strength over the winter but June is more likely being negatively influenced from the growing global economic moderation that will likely intensify in the 2nd half, thus furthering the malaise in the labor market. While a figure like today will only invite more FOMC deliberations, if only cheap money was the magic elixir to what ails us, the global economy would be roaring. Deleveraging however is the only real, long lasting cure.

Walter Russell Mead bets on political and economic ineptitude:

There are those who say we need to print much more and spend much more to get the economy going again, and those who say that doing that will just get us deeper in the hole with nothing more to show for it. The likely result of this impasse is that we won’t do what anybody recommends, but bumble along instead halfway between the two extremes, hoping something turns up. And if we’re lucky, which I think we probably will be, the politicians won’t do the equivalent of pouring sugar in the gas tank by failing to resolve the budget and tax crunch coming at the end of the year. That’s not a solution; it just means we won’t deliberately drive our car into the ditch.

Daniel Gross strains his eyes searching for silver linings:

You have to look deep into the numbers to find upbeat data inside a report like the June report. But there is some. In recent years, there have been plenty of months in which the labor force shrank, as people grew discouraged that they simply went to the sidelines. In June, the labor force grew by 156,000, and in the past year it has risen by nearly 1.66 million. As hours worked and average hourly earnings both rose, average weekly earnings rose by .5 percent in the month, which isn't bad.

Ed Kilgore considers the political implications:

We’ll see how the spin goes, but this is precisely what Mitt Romney’s beleaguered campaign team needed today: an excuse to get back to what it does best, which is mindless fulmination over short-term economic indicators.

And Christopher Matthews focuses on the plight of the unemployed

Of course the real losers in this situation aren’t the politicians, but the more than 5.4 million Americans among the long-term unemployed. According to the National Employment Law Center, recent changes to the federal unemployment benefits program and the expiration of some state programs will cause half a million of these workers to lose their benefits by the end of August.

Planet Money charted the long-term unemployment numbers. Chart above by Jared Bernstein.