Binyamin Applebaum reviews the administration's mortgage policies. Yglesias reflects:

[T]he economic team wasn't saying there was nothing they could do on housing. Nor were they saying that doing more on housing was a bad idea. They were saying that given finite financial resources they thought investing money in homeowner relief was a poor use of money compared to other initiatives they deemed more stimulative. The basic idea was that you needed the best possible stimulus and thus the lowest possible unemployment rate and this would be the best possible housing policy. It made sense to me at the time, and I think it still makes perfect sense in retrospect.

Ezra Klein calls the White House's housing failures the "best case against the Obama administration":

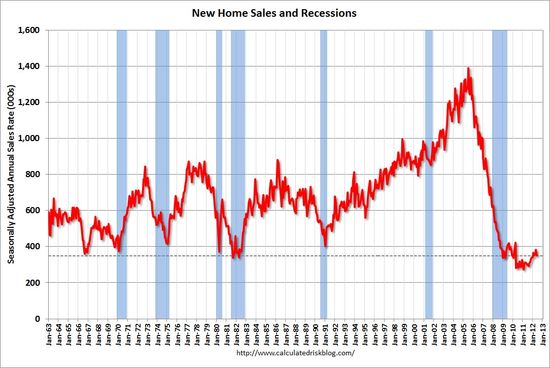

[O]ne view is that the administration basically got the crisis backward. You couldn’t fix the housing crisis by fixing the economy. You had to fix the economy by fixing the housing crisis. And the administration’s housing policy wasn’t anywhere near sufficient to do that. This mistake was doubly disastrous because monetary policy, which would normally be a huge driver of recovery, typically works through the housing market, encouraging consumers to buy new homes while interest rates are low. Leaving the housing market’s dysfunctions to fester also meant that the Federal Reserve’s efforts to lower long-term interest rates had little affect on the economy.

(Chart from Calculated Risk)