by Gwynn Guilford

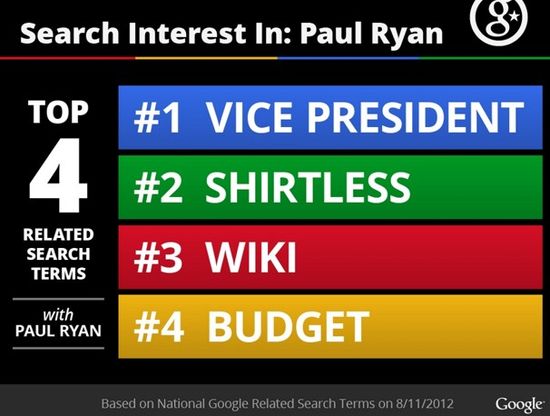

As per Patrick's earlier post, it seems like a clear no. However, a former index-fund analyst writes in to say Ryan's excuse – that the trades of Citigroup, Goldman Sachs and JP Morgan that seemed to coincide with a momentous meeting on Big Finance on the same day were traded within the Russell 1000 index fund – doesn't compute:

This is simply and utterly wrong. The whole point of a mutual fund is you farm out the trading of the individual holdings to a manager. Index funds are not an exception. If you're trading individual equities, you are not trading in and out of a mutual fund. And even if Ryan's investment people were indexing – i.e. following a strategy in which they mimic the returns of the Russell 1000 index – then they would have traded in and out of individual stock positions only on Russell's publicly announced reconstitution days, not "at various points throughout the year."

He points us toward Brad DeLong's take on the situation (to follow what he's referring to, see pages 12 and 13 of Ryan's 2008 returns (PDF)):

There is no way in hell–if you are rebalancing to try to track the Russell 1000 index–you make only 58 trades in a year, that you make 27 of those 58 in large money-center banks, and that 10 of those trades involve shifting your money from Citi to Goldman and back five times. No way in hell. I don't know what was going on. But it appears that Ryan's flacks are–for some reason–simply making s@#& up.

Okay, so Ryan wasn't guilty of insider trading. But his spokesperson was clearly dissembling about the nature of the trades. Why, though? DeLong's comments section offers a sound hypothesis about the trading strategy at play:

It is very obvious what was going on. This was tax-loss harvesting, designed to avoid the 30 day wash sale rule. All the sales came 30 days or more after purchases and everytime something was sold, a correlated asset was bought. Rebalancing the index??? That is hilarious.

Another explains why Ryan's tax-loss harvesting was focused on the financial stocks – to catch an anticipated sector rebound while taking advantage of the losses for tax purposes. Keeping the financial stocks in a holding pattern, if you will. Here's the finer grain of sleuthing from DeLong's reader:

I've got a different theory. I'm willing to believe that these were arms-length trades executed by his advisers, but I think he's being deliberately disingenuous about what they were up to. This strikes me as a trading scheme devised to take advantage of the tax law, by harvesting losses.

Here's what happened. Starting on June 25 of 2007, his disclosure forms show that 'RHIP' – presumably, Ryan-Hutter Investment Partnership – purchased individual stocks in eight extremely large-cap firms. It's an idiosyncratic group, weighted toward financials, but there may have been some sort of underlying logic. He added a ninth, Wachovia, in August – and made some additional purchases as the year went on. And in 2007, there's no rapid-fire trading in and out of these stocks. It's straightforward buy-and-hold.

That changes in 2008, as the financial crisis sets in. It's not clear exactly how much money Ryan had tied up in these purchases – they were all initially in the $1k-15k range, so somewhere between $9k and $135k, which is pretty much useless. But remember, financials were plunging. He's taking a bath. On the other hand, as we went through the crisis, lots of folks expected us to hit a floor and rebound.

On reasonable strategy, under those circumstances, is to maintain the same overall level of exposure to the sector, but to ensure that you've always registered the maximum losses…. So once a month, you look at your holdings. If your stock in a particular company is down, you sell it, and buy shares in another firm, locking in the losses while maintaining your chance of enjoying any recovery. If it's up, or stagnant, you hold for another month to see what happens – or maybe even buy some more.

If you match up the dates of Ryan's purchases and sales with stock prices, that's precisely what you see. He always bought high and sold low. It's part of what makes the insider-trading charge absurd. No one's that unlucky; Ryan was deliberately registering losses on these sales. That seems strange. But if you're trying to stay in a sector to catch an eventual rebound, and want to maximize your losses for future taxes, it makes a fair degree of sense. And sure enough, once 2009 rolls around and the markets achieve a degree of stability, the strange sales suddenly stop.

So why doesn't his spokesperson just say that? Why the strange explanation involving indexes and partnerships and algorithms? My guess is that Ryan recognizes that the truth here would be awkward. "Well, in 2008, a family partnership in which I hold a 20% non-controlling interest executed a series of trades designed to minimize my future tax liabilities. I was loss-harvesting to shield my future income. That's what you're seeing on these forms."

Things that seem normal to the tiny fraction of Americans with family trusts and tax attorneys are likely to strike the average voter as immoral, unethical, or dishonest – even when they're perfectly legal. Mitt Romney has already discovered this, much to his chagrin. Ryan would far rather put out a smokescreen related to the Russell 1000 and wait for reporters to realize that there wasn't any insider trading, than explain forthrightly what this was actually all about.

Pure cynicism on the parts of Romney and Ryan. But very consistent with the larger disdain for voters' intelligence and intergrity.