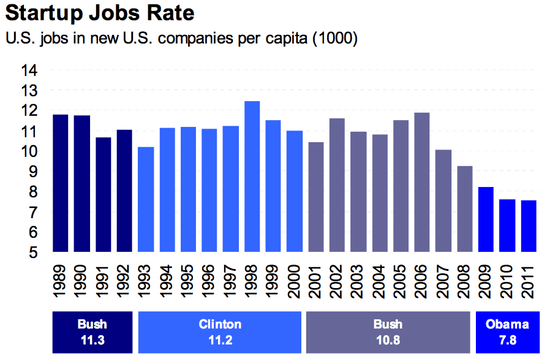

Felix Salmon unravels the findings of a paper (pdf) by Tim Kane on the implosion of startup-driven job creation:

Concentrating on startups is not going to move the broader employment needle very much. But the dynamic here is surprising and troubling, all the same. Intuitively, if people can’t find work for an existing company, they should be more likely, not less likely, to go out and found a new company themselves, instead. But that doesn’t seem to be happening.

Salmon adds:

[F]or all that we think of startups as being largely high-tech things, in reality a huge number of them are in the construction industry, in one way or another. In a word, subcontractors. And no one’s starting new granite-countertop installation companies right now.

A new Fannie Mae study of the ailing residential construction industry digs (pdf) into how the housing bust factors into the anemic recovery:

[J]ob loss, as opposed to average wage decline, is the principle culprit underlying the weak aggregate earnings recovery. What’s more, the analysis identifies construction job losses, in particular, as a primary force behind this business cycle’s comparatively weak aggregate earnings performance.