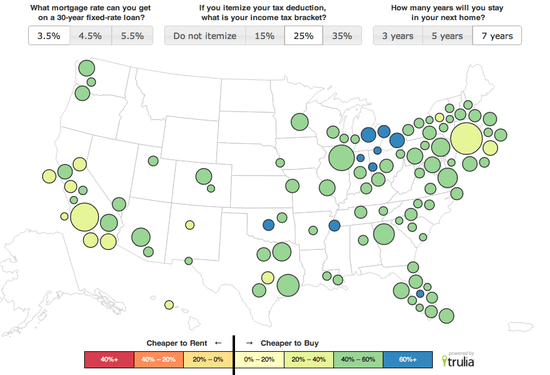

Crunching the number on renting versus buying, Jed Kolko makes the case for the latter:

Based on asking prices and rents during the summer of 2012, buying is now 45% cheaper than renting in the 100 largest U.S. metros, on average – that’s a savings of $771 a month. If you plan to stay in a home for 7 years, which is the average time that Americans traditionally live in a home before moving again, it is more affordable to buy than to rent in ALL of the 100 largest metros in the U.S.

He explains why, despite the pro-buying conditions, people are still renting:

The big obstacle holding back renters who want to buy is the down payment – even more than getting a mortgage. And keep in mind, in the metros where the cost of buying is less than half of what it would cost to rent over the long term, it still takes years to save enough for a down payment. It may be 56% cheaper to buy than to rent in Denver, for instance, but it takes more than 8 years to save enough for a down payment there.