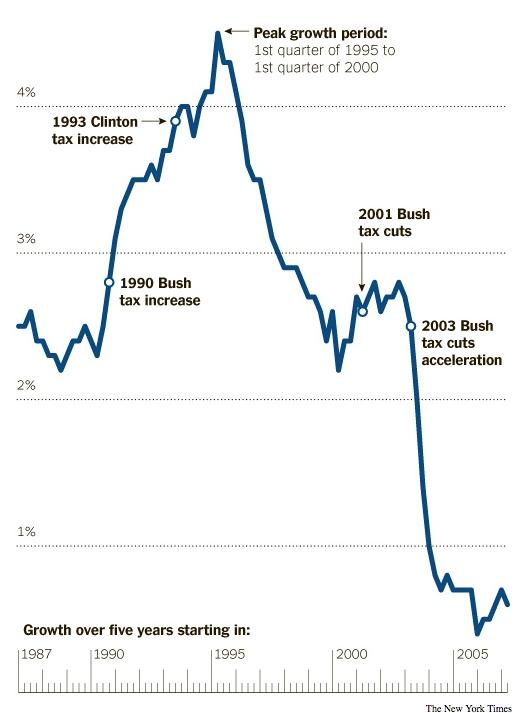

After a terrific David Leonhardt piece, Derek Thompson highlights the findings of a Congressional Research Service study (pdf) – that tax cuts don't generate economic growth. Thompson summarizes:

Analysis of six decades of data found that top tax rates "have had little association with saving, investment, or productivity growth." However, the study found that reductions of capital gains taxes and top marginal rate taxes have led to greater income inequality…. Well into the 1950s, the top marginal tax rate was above 90%. Today it's 35%. But both real GDP and real per capita GDP were growing more than twice as fast in the 1950s as in the 2000s. At the same time, the average tax rate paid by the top tenth of a percent fell from about 50% to 25% in the last 60 years, while their share of income increased from 4.2% in 1945 to 12.3% before the recession.

Meanwhile, Leonhardt recalls how Paul Ryan reflected on the above chart in one of their conversations:

“I wouldn’t say that correlation is causation,” Mr. Ryan replied. “I would say Clinton had the tech-productivity boom, which was enormous. Trade barriers were going down in the Clinton years. He had the peace dividend he was enjoying…. Some of this is just the timing, not the person,” he said.

He then made an analogy. “Just as the Keynesians say the economy would have been worse without the stimulus” that Mr. Obama signed, Mr. Ryan said, “the flip side is true from our perspective.” Without the Bush tax cuts, that is, the worst economic decade since World War II would have been even worse.

I don't understand why these people cannot grasp that bringing a tax rate of over 70 percent way down to the 30s can make a big difference, especially if you cut loopholes. But that cannot be repeated. Once you're in the 30s, the ammunition is much much smaller. The idea that bankrupting the government under Bush and Cheney would have been worse if they had not cut taxes requires the kind of voodoo that George H W Bush once elegantly pointed out.