Barro looks at the best estimates we have:

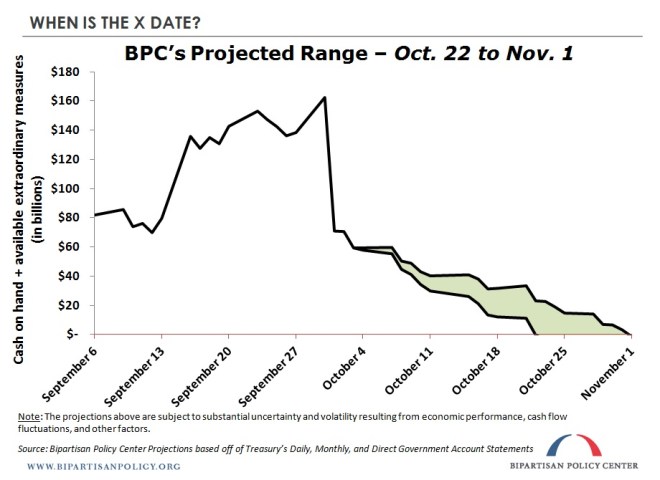

People have been talking a lot about Oct. 17. That’s the day the Treasury Department expects to exhaust ”extraordinary measures” that allow the government to finance itself without issuing Treasury bonds, such as borrowing from various government trust funds. But even when that happens, the federal government will have about $30 billion in cash left on hand, and every day it will collect more revenue. That means it will be able to go a few more days, or possibly as long as two weeks, without missing payments. The Bipartisan Policy Center has projected daily cash inflows and outflows and has narrowed the possible range for the “X date” — the first day the government can’t make all its payments due — as Oct. 22 to Nov. 1.

Matthew O’Brien also examines the government’s balance sheet and uses it to argue that debt prioritization won’t work:

[E]ven if the government is completely competent, the Treasury could still miss a debt payment. Why? Well, payments and revenues are lumpy. We owe more on some days, and we have more cash come in on some days. More importantly, we owe bondholders more on some days. So the question is whether there could ever be a particular day when we owe more in interest than we have in cash on hand. And there is.

Larison adds:

So the Republican members of Congress telling the public that they don’t need to worry about the danger of default if the debt ceiling isn’t raised are simply wrong. They are misinformed, and they are misinforming the public. They need to stop, but unfortunately many of the sources that they rely on for their news and analysis are recycling the same bad information.