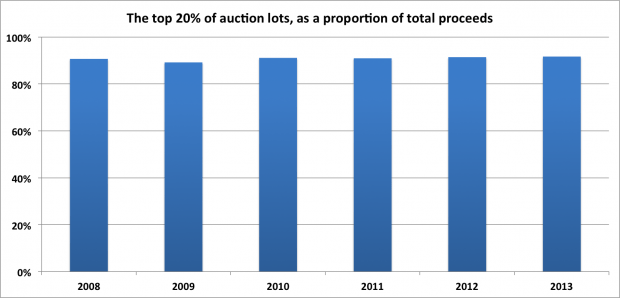

Felix Salmon presents the above chart, showing that the art market is actually remarkably stable, as “the top quintile of art works will always accounts for 90% of the value of the art sold”:

[T]he fact is, statistically speaking, that the distribution of art-market values never really changes at all. What’s true today was true yesterday, and was true a decade ago as well. The only difference is the way in which the art-market caravan has moved on and anointed a new set of art works as being the “masterpieces” worth spending insane amounts of money on.

Similarly, every season there’s breathless coverage of new auction records — a long list of artists, all of whom just saw a work sell for more money than that artist has ever received at auction before. The auction houses love to present those auction records as a sign that the market is particularly healthy. But in fact, it’s more of a sign of how fickle both the auction houses and the art market are. Each season, a new artist is hot, and sells for high prices; the superstars of yesteryear, by contrast, aren’t even accepted for auction at all, much of the time. Today’s masterpiece is tomorrow’s mildly embarrassing reminder of how bad our taste used to be.

Relatedly, Jed Perl fears that the “art world has become a fantasy object for the professional classes”:

To argue that an artist whose work sells for a few hundred or a few thousand dollars is superior to an artist whose work sells for millions is to invite condescension if not outright ridicule. The relationship between culture and commerce is frozen, with commerce invariably the winner.

Recent Dish on the art market here.