Now that S&P has downgraded its bonds to junk status, Salmon expects Puerto Rico to default soon. But he notes that “there’s no chapter of the US bankruptcy code which encompasses Puerto Rico”:

My advice to the Puerto Rican government, then, is this: start having quiet conversations in Washington about a piece of legislation which would give the island the legal freedom and ability to restructure its debts in a clean, one-and-done manner. Such a law would not be a bailout: it would involve no money flowing from DC to PR. But it would allow Puerto Rico to default on its debt and come out the other side, without the risk of years of legal chaos. While bondholders would squeal, at least they would get certainty. And Puerto Rico would get something much more valuable still — an opportunity to finally drag itself out of its horrible recession.

Roberto Ferdman comments on the situation:

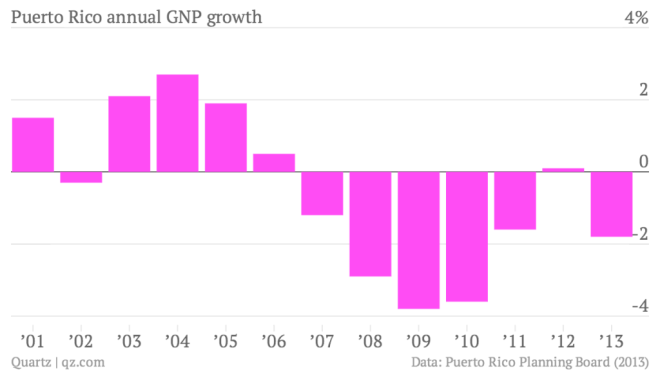

Puerto Rico is in a pretty precarious spot. But it’s hardly something that happened overnight. The island has been crawling its way toward today’s economic mess for quite some time. “If you look at the numbers, the economy has shrunk by something like 15% over the past six or seven years,” economist José J. Villamil told Quartz. Puerto Rico’s economy has been getting smaller for almost eight years, as the chart [above] shows.

The Economist worried about default back in October:

For decades Puerto Rico has been sustained by federal subsidies. Its people, far poorer than the American average, get lots of transfers, from pensions to food stamps. Until 2006 the economy was buoyed by tax incentives for American firms that manufactured there. As drug companies took advantage, the territory became a vast medicinalmaquiladora.

This tax break disappeared in 2006, and Puerto Rico’s economy has shrunk virtually every year since. It has been able to keep on borrowing, thanks to another subsidy: interest on Puerto Rican debt is exempt from state, local and federal taxes in America, making it artificially attractive to investors.