That’s how Neil Irwin reads the new GDP numbers:

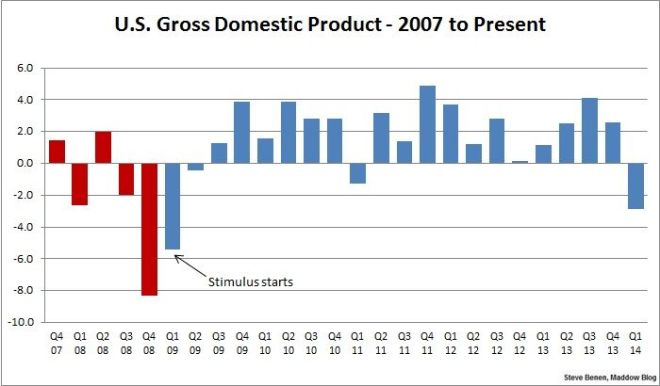

The Commerce Department revised its estimates of first-quarter gross domestic product Wednesday to show that the economy contracted at a 2.9 percent annual rate. A combination of shrinking business inventories, terrible winter weather and a surprise contraction in health care spending drove the first-quarter decline, which is the worst since the first quarter of 2009, when the economy shrank at a 5.4 percent rate.

And that contraction is worse than expected; forecasters had predicted only negative 1.8 percent. Ben Casselman has more:

Last month, I noted that negative quarters are rare outside of recessions. Quarters this bad are even rarer. There have been only two other non-recessionary quarters since World War II when the economy shrank at a rate over 2 percent. Both times, the economy entered a recession the following quarter.

That doesn’t mean we’re about to fall back into a recession. On several other occasions, negative quarters were followed by a strong rebound. Just a few years ago, for example, U.S. GDP fell 1.3 percent in the first quarter of 2011, then bounced back to post a 3.2 percent growth rate in the second quarter.

Then again, it’s worth remembering that we’re notoriously bad at predicting recessions. In fact, we aren’t even very good at knowing when we’re in one. The semi-official arbiters at the National Bureau of Economic Research didn’t identify the most recent recession until December 2008, by which point it had been underway for a year; they didn’t pick up on the 2001 recession until it was over. If we were in a recession now, we might not know it.

But Danielle Kurtzleben isn’t too worried:

Weather accounted for somewhere between 50 and 100 percent of the GDP pullback, says PNC senior economist Gus Faucher. When polar vortexes and multiple feet of snow keep people stuck at home, they just can’t get out to buy groceries or see the doctor. That’s only a temporary hit to the economy — everyone has to go to the doctor and buy food again at some point. …

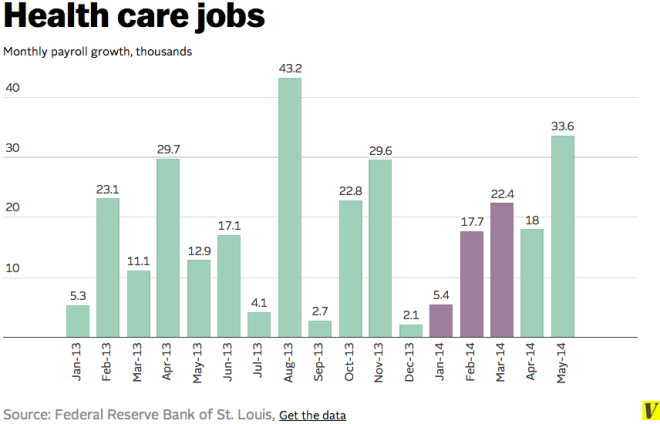

Broadly speaking, the job market isn’t growing as fast as we’d like it, but it didn’t seem to pull back in the first quarter. And though healthcare helped pull GDP downward in the first quarter, even employment in that industry didn’t appear to take a hit:

Danny Vinik details the dip in healthcare spending:

[The new GDP data] may be a case of bad news that’s not so bad – and maybe even good.

The reason why consumer spending fell is that health care spending decreased by 1.4 percent in the first quarter. In fact, in the BEA’s second estimate, health care spending contributed 1.01 percent to the growth rate. Under the third estimate, it subtracted 0.16 percent. In other words, health care spending went from a strong contributor to GDP growth to a detractor from it – all in a quarter when millions of Americans gained health insurance.

Daniel Gross wonders what caused that 0.16 revision:

It could be that people were hoarding medicines and avoiding going to the doctor during the cold weather. Or it could be that many newly insured people delayed going to see the doctor, buying medicine, or having procedures done in January, February, or March until their health-care premiums were fully processed by the state and federal exchanges in April. (Remember, April 1 was the deadline for signups under the Affordable Care Act). It could be that doctors are rationing health care—refusing to schedule appointments. Or it could be that many people are actually paying less for health care because they have insurance—i.e., seeing doctors with a $25 co-pay instead of going to the emergency room.

Clearly, the implementation of Obamacare is disrupting and disturbing the way that health-care services are being priced and consumed. In the first quarter, that led to lower spending—either through lower utilization, or lower prices, or some combination thereof.

Matt O’Brien calls that decline in healthcare spending “good news for our long-term budget, but bad news for our short-term growth”:

Still, this is something of the soft bigotry of a slow recovery’s expectations. The economy should be able to withstand some bad weather and bad inventories without falling back into negative territory. And it should be growing faster now to make up for that slower growth before, if the first quarter really was a blip.

Suderman gets snarky:

At the end of April, when the monthly GDP report found a sluggish, barely growing economy that had expanded by just 0.1 percent in the first quarter of the year, former White House Press Secretary Jay Carney found the good news. Health care spending was up, way up, thanks to Obamacare. The Bureau of Economic Analysis (BEA) had found that health spending had grown by 9.9 percent, the fastest growth of any quarter since 1980. The health law was working—and had saved the economy! … This was a bit rich coming from the same White House that had argued for years that the health law would hold health spending in check.

But now there’s another problem: Health spending appears not to have grown at a record rate during the first quarter of the year. It didn’t grow at all. In fact, it shrank by 1.4 percent, according to a revision released today by the BEA. … Perhaps, however, the White House, in its boundless optimism, will find the upside: The administration can now go back to arguing that Obamacare is working because it’s causing health care spending to shrink.

Matt Phillips looks ahead:

We’ll have to wait until the Census Bureau’s next services survey report in September to see whether medical care usage actually does pick up. That would stand to reason. Government estimates of increased healthcare spending were “probably more early than wrong,” wrote Morgan Stanley economic analysts in research notes. “Coverage has, in fact, expanded significantly this year, and that should support higher healthcare spending.”

Drum isn’t too optimistic:

Everyone is brushing off [the GDP decline] because other economic signals suggest it was a one-off event. And maybe so. But even if it is, it probably knocks about 1 percent off the full-year figure compared to a more normal growth rate of, say, at least 2 percent. The only way it turns out to be a nothingburger is if this number really is an anomaly and the economy makes up for it with supercharged growth for the rest of the year.

I have my doubts about that. I just don’t buy the tired excuse that the Q1 number was weather related. Something happened.

(Chart from Benen)