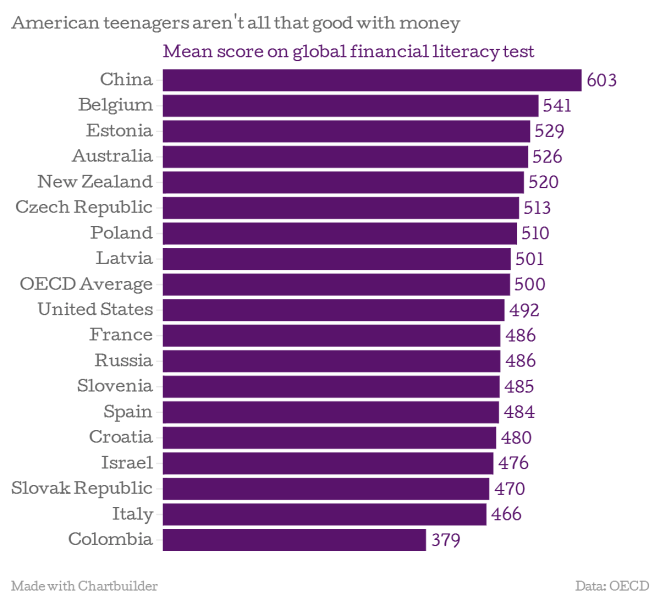

Roberto Ferdman charts the findings of a new report on financial literacy:

A comprehensive study carried out by the OECD (pdf) has unearthed yet another lagging indicator for the American education system. The study, which examined the results of a financial literacy test that quizzed some 30,000 students in 18 countries around the globe, found that 15-year-olds in the U.S. aren’t all that good with money. In fact, they’re pretty mediocre with it. America’s youth are, according to the results, “not statistically significantly different from the OECD average.”

Laura Shin notes that the top-scoring kids came from Shanghai:

There, students scored 603 points on an assessment run by the Programme For International Student Assessment (PISA) by the Organization for Economic Cooperation and Development (OECD). The average was 500, and the United States’ mean was 492. That put it slightly below the average of the the 13 OECD countries and economies assessed; among all 18 countries and economies included, the U.S. ranked between 8 and 12. The other countries and economies whose students, in addition to Shanghai’s, scored above the OECD average were Australia, the Flemish Community of Belgium, the Czech Republic, Estonia, New Zealand and Poland.

Emily Richmond isn’t surprised by the results:

The ranking of U.S. students in the new assessment is consistent with the nation’s stagnant performance on the most recent PISA for math and reading—two skills that track closely with financial literacy. And it’s in keeping with prior findings. In a 2008 national survey by the JumpStart Coalition for Personal Financial Literacy, high school seniors gave correct responses to less than half – 48.3 per cent – of the questions on the basics of finance.

Allie Bidwell breaks down the findings further:

[M]ore than 1 in 6 American students – 17.8 percent – did not reach the baseline level of proficiency, meaning they could not correctly answer a “level two” question. At best, those students could determine the difference between needs and wants, make simple spending decisions and apply basic numerical operations, according to the report. Conversely, about 1 in 10 American students scored as a top performer, meaning they were able to answer the most difficult “level five” questions on the exam that focused on analyzing complex financial products and demonstrating an understanding of topics such as income-tax brackets and the benefits of different types of investments.

Presumably it’s harder for teens to develop financial literacy when they can’t find a job.