Neil Irwin delivers a reality check:

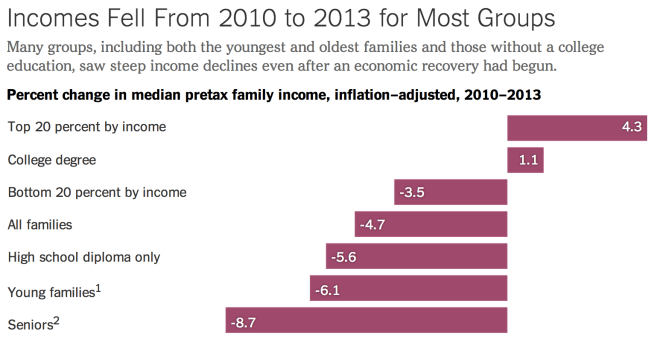

Many groups, including both the youngest and oldest families and those without a college education, saw steep income declines even after an economic recovery had begun. Separate people by age or education, and the same basic pattern applies. Those with a college degree have done fine, but anything less than that and incomes have fallen. Both young adult households (those headed by someone under 35) and those households headed by someone over 75 have seen steep income declines in that same period.

This is the simplest yet most important fact to understand about the current economic recovery: It has not resulted in higher incomes for anyone other than those who were already doing well. And very large groups of Americans have experienced falling incomes.

Late last week, Ben Casselman and Andrew Flowers also covered the continued fallout from the Great Recession. They warned that the young may be in even worse shape than the numbers suggest:

Many young people are living with their parents because they can’t afford to strike out on their own; they aren’t included in the Fed’s figures because they don’t count as their own households. Young people have also become less likely to own their own homes (35.6 percent listed their primary residence as an asset in 2013, down from 40.6 percent in 2007) and much more likely to have student debt (41.7 percent in 2013, up from 33.8 percent in 2007). Whether by choice or by necessity, young people are also taking fewer financial risks, holding more of their assets in cash and less in stocks.