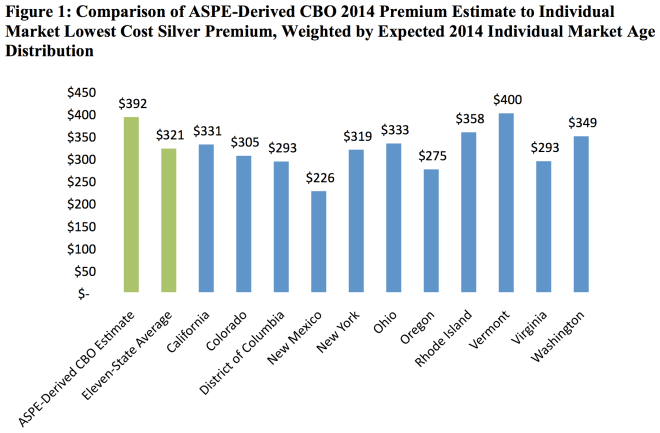

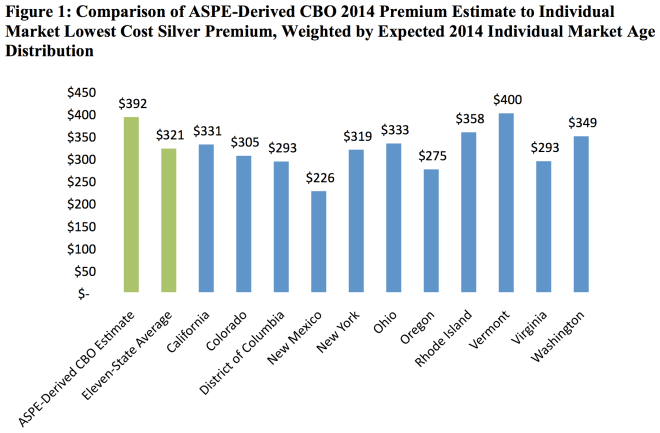

The above chart comes from an Assistant Secretary for Planning and Evaluation (ASPE) report (pdf) on Obamacare’s exchanges. The big finding:

In the eleven states for which data are available, the lowest cost silver plan in the individual market in 2014 is, on average, 18% less expensive than ASPE’s estimate of 2014 individual market premiums derived from CBO publications.

Sarah Kliff explains the chart:

What you’re looking at here shows what insurance plans will charge for coverage that will cover 70 percent of a typical subscriber’s health-care costs. These are averages of the second-lowest cost plans that provide this level of coverage (silver plans, as they’re known under the health-care law)

Jonathan Cohn considers why the premiums are coming in lower than expected:

The law’s critics and, by the way, quite a few insurance industry officials warned that premiums were going to exceed official expectations. The reason: Insurers couldn’t assume that young and healthy people would sign up for coverage. Without those customers, insurers would be left covering people who were predominantly older and sicker—and, as a result, more likely to run up big medical bills. In response, Obamacare’s defenders—or, more accurately, its believers—argued that the combination of subsidies and the individual mandate would be sufficient to entice enough young, healthy people. They also predicted that insurers, facing the prospect of losing customers to rivals, would opt to keep premiums relativley low.

For the moment, at least, the believers’ case looks pretty strong. A brand-new paper from the Robert Wood Johnson Foundation paper, prepared by Linda Blumberg and John Holahan the Urban Institute, may offer a clue why. The paper suggests that most people buying coverage on their own next year will be as healthy, if not healthier, than the typical person who today gets insurance though a job. Maybe the insurance industry’s own actuaries have, after looking carefully at the figures, come to the same conclusion.