Today on the Dish, rifts in the GOP leadership deepened, Andrew called them on their panic, and wasn't buying their dishonest memories of Bush as budget master. Andrew defended Obama's plan, Ezra sized up the cuts, and prisons robbed us blind. Henry Blodgett dared to question Palin's pregnancy, Andrew hoped we were reaching critical mass, and we remembered Palin's crush on Ivana. We measured how many could ride on Obama's tiny coattails, Mark Blumenthal rooted for the underdogs in Iowa, and Romney wasn't throwing in the cards yet.

Dani Rodrik defended dining with dictators, kids these days didn't know better about torture, a reader criticized the study's methods, and we eavesdropped on North Korea's cellphone conversations. We got an update on Libya's genocide threat, NATO was still debating whether to arm rebels, and Ackerman checked in on our exit from Iraq. PM Carpenter bashed the Beltway's rules, and Andrew drummed up pity for the unpaid HuffPo bloggers.

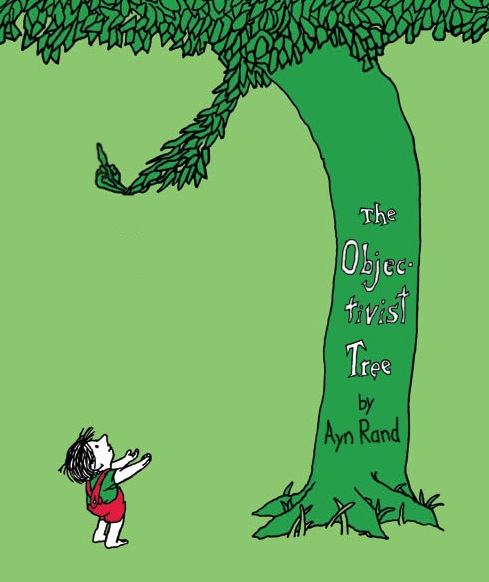

The Civil War lived on, Andrew ripped apart the culture war's stigmas against gay kids, and abortion remained personal. Readers kept tabs on our tax brackets, a startup could fund college kids to drop out, and cheap bus travel wooed customers. Books made a beeline for perfumes, Andrew didn't hop on the Foodie bandwagon, but we can blame that on jellied eels. Southpark weighed in on The Giving Tree, readers identified with the empty trees, Andrew judged American Idol, and the three elements of Dishness converged.

Deep thought of the day here, VFYW here, headline of the day here, quote for the day here, poseur alert here, MHB here, and FOTD here.

–Z.P.